The longer you wait, the harder it is to get paid. Always chase up late payments in a timely manner Thus always have a PO before commencing work 7. You have done the work and ask for a PO, and then you get the run-around ‘we are waiting for accounts…’ and you can’t invoice without one, because their terms of trade say ‘every invoice must include a PO number…’ You may get caught in the red tape especially with larger companies. If you end up in court, they can afford an expensive legal battle whilst you bleed cash 6. There are charming wealthy customers who have become wealthy by taking advantage of smaller businesses. Increase the speed of cash inflow by reducing credit term with your clients and decrease the speed of cash outflow by extending term with the creditors 5. Do not try to conserve cash by not paying your suppliers on time as this is a short term solution that will come back and bite you 4. Go see them and make a deal for revised payment terms. (b) Decrease the speed of cash outflow by extending your payment terms with your suppliers. (a) You could increase the speed of cash inflow by negotiating reduced credit terms with your customers. Run credit checks on your customer(s) before accepting them or allowing payment terms, this will reduce the risk of delayed (or no) payment or bad debt 3. Anticipate and be prepared for the unexpected by stress testing various scenarios e.g. Keep your book keeping up to date on all cash inflows and outflows (actual and forecast). It is crucial to have a cash flow forecast going out at least six to nine months to see potential shortfalls and have sufficient time to react. So here are the top 10 ways to improve your cash flow: 1.

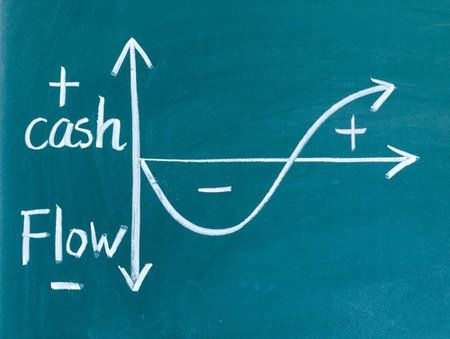

Therefore it is essential that business owners develop good cash management practices. It is of vital importance to the health and success of a business. Cash flow is unquestionably the lifeline of any business.

0 kommentar(er)

0 kommentar(er)